Compare auto insurance quotes in texas – Comparing auto insurance quotes in Texas is crucial for finding the best rates. This guide delves into the Texas auto insurance market, exploring factors influencing premiums, and offering strategies to secure affordable quotes.

Understanding the diverse range of coverage options, comparing multiple quotes from different providers, and evaluating policy terms are all vital steps in this process. We’ll also discuss how to navigate the application process and choose the right insurance provider to meet your needs.

Introduction to Auto Insurance in Texas

Auto insurance in Texas is a complex system, significantly influenced by factors like driver demographics, vehicle types, and driving habits. Understanding these elements is crucial for securing affordable and adequate coverage. Premiums are not a fixed amount, and the cost varies greatly depending on individual circumstances.Texas’s auto insurance market is highly competitive, with numerous companies vying for customers.

This competition, however, doesn’t negate the need for thorough research and comparison shopping to find the best possible rates. Factors such as driving record, age, and location all play a role in the final price.

Types of Auto Insurance Coverage

Texas law mandates specific types of coverage for all drivers. Understanding the different coverages available is essential to protecting yourself and your assets. This includes liability coverage, collision coverage, comprehensive coverage, and more.

- Liability Coverage: This type of coverage protects you if you’re at fault for an accident, covering the other driver’s medical expenses and property damage. It’s the most basic form of insurance required by law in Texas.

- Collision Coverage: This coverage pays for damage to your vehicle regardless of who is at fault. It’s a crucial layer of protection for your investment in your car.

- Comprehensive Coverage: This coverage extends beyond collisions, encompassing damage from events like vandalism, theft, fire, or hail. It provides an extra layer of protection for your vehicle.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. This is a critical coverage option in a state with a high rate of uninsured drivers.

Legal Requirements for Auto Insurance in Texas

Texas has specific legal requirements regarding minimum insurance coverage amounts. Failing to meet these requirements can lead to significant penalties.

Minimum coverage requirements are legally mandated to protect all parties involved in a vehicle accident.

The following table summarizes the minimum insurance requirements for various vehicle types in Texas.

Minimum Insurance Requirements by Vehicle Type

| Vehicle Type | Bodily Injury Liability (per person) | Bodily Injury Liability (per accident) | Property Damage Liability |

|---|---|---|---|

| Personal Vehicles | $30,000 | $60,000 | $25,000 |

| Commercial Vehicles | $100,000 | $300,000 | $50,000 |

| Motorcycles | $30,000 | $60,000 | $25,000 |

Note: These are minimum requirements; higher limits are often recommended for comprehensive protection. It’s advisable to consult with an insurance professional to determine the appropriate coverage levels for your individual needs.

Understanding Quote Comparison Websites

Quote comparison websites streamline the process of finding the best auto insurance rates in Texas. These platforms aggregate quotes from multiple insurance providers, allowing consumers to easily compare options and potentially save money. They often provide valuable tools and resources to help users understand their coverage options.These platforms offer a convenient way to compare various insurance policies tailored to individual needs.

They act as intermediaries, collecting and presenting quotes from different providers, effectively reducing the time and effort required for comprehensive comparisons. This convenience factor, coupled with the potential for significant cost savings, makes these websites popular choices for Texas drivers seeking auto insurance.

Functionalities of Comparison Websites

Comparison websites in Texas leverage technology to gather and present a broad range of auto insurance quotes. These platforms typically allow users to input their vehicle information, driving history, and desired coverage levels. This information is then used to query multiple insurance companies, generating a customized selection of quotes. The results are usually presented in a user-friendly format, enabling easy comparison based on factors such as premiums, coverage options, and deductibles.

These platforms often offer detailed policy summaries and explanations to help users understand the various coverage details.

Factors Influencing Quote Accuracy

The accuracy of quotes displayed on comparison websites is influenced by several factors. These websites depend on the data provided by participating insurance companies, and discrepancies or inconsistencies in data entry can affect the accuracy of the quotes. Furthermore, the specific coverage selections made by the user, such as desired deductibles and add-ons, directly impact the final quote.

The websites’ algorithms, designed to match user needs with available quotes, also play a role in the accuracy of the presented information.

Steps to Obtain Quotes

A typical process for obtaining quotes from various providers using a comparison website involves several steps:

- Inputting personal information, including vehicle details, driving history, and desired coverage.

- Selecting specific coverage options and deductibles.

- Reviewing the displayed quotes from different insurance companies.

- Comparing the quotes based on premium costs, coverage details, and any additional features.

- Contacting selected insurance providers for further information and clarification.

These steps ensure a thorough comparison of various insurance options available in Texas. The process is designed to be straightforward and user-friendly.

Comparison Website Features and Benefits

Different auto insurance quote comparison websites offer varying features and benefits. These platforms often provide tools for comparing different coverage options and pricing from various providers.

| Website | Features | Benefits |

|---|---|---|

| Example Website 1 | Detailed policy explanations, interactive maps for claims filing, mobile app | Clarity on coverage, convenience, efficiency |

| Example Website 2 | User-friendly interface, personalized recommendations, discounts | Ease of use, tailored recommendations, potential cost savings |

| Example Website 3 | Comprehensive search filters, in-depth coverage comparison, customer support | Specific coverage options, comprehensive comparison, assistance |

These websites facilitate informed decision-making by presenting a comprehensive overview of available options and helping users compare coverage and pricing from various providers.

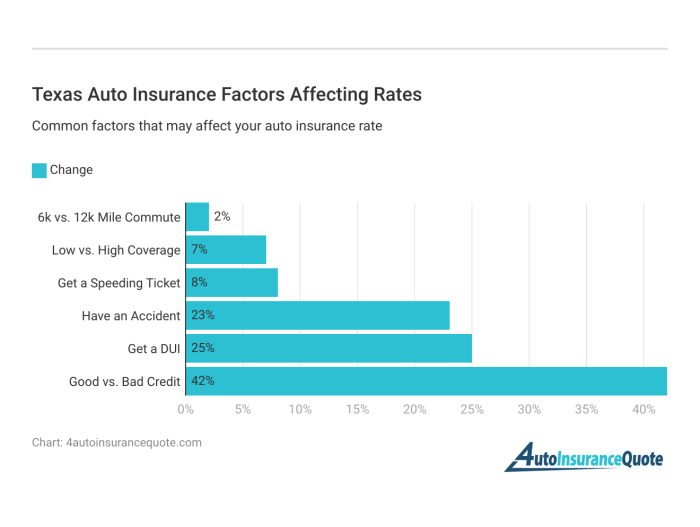

Factors Affecting Auto Insurance Premiums in Texas

Auto insurance premiums in Texas, like in many other states, are influenced by a variety of factors. Understanding these factors is crucial for consumers seeking to compare quotes and potentially reduce their costs. Knowing what impacts your premium allows you to make informed decisions about your coverage and potentially negotiate better rates.The following factors significantly impact your auto insurance premium in Texas.

They range from your driving history and vehicle type to your location and credit score. Analyzing these elements will give you a more complete picture of your potential insurance costs.

Driving Records

Driving records are a primary determinant in auto insurance premiums. A clean driving record, with no accidents or traffic violations, typically results in lower premiums. Conversely, drivers with a history of accidents or moving violations face higher premiums due to the increased risk associated with their driving habits. Insurance companies assess these risks and adjust premiums accordingly.

Insurance companies look for frequency and severity of accidents. A single accident might not be as impactful as multiple accidents or a serious accident.

Vehicle Characteristics

The type of vehicle you drive significantly influences your auto insurance premium. Sports cars, for example, tend to have higher premiums compared to sedans due to their perceived higher risk of theft or damage. Similarly, SUVs, often larger and heavier, may also incur higher premiums. These premiums reflect the potential for greater financial loss in an accident or theft, reflecting the vehicle’s value and potential for damage.

Geographic Location

Geographic location plays a significant role in Texas auto insurance premiums. Areas with higher crime rates, higher accident rates, or more severe weather conditions typically have higher premiums. Factors such as the density of traffic and the frequency of accidents in specific regions impact the overall risk assessment for insurance companies, which is reflected in the premiums.

Credit Scores

Surprisingly, your credit score can also affect your auto insurance rates in Texas. Insurance companies often use credit scores as an indicator of your financial responsibility and risk profile. A lower credit score often leads to higher premiums. This correlation is based on the assumption that individuals with better credit scores tend to be more responsible financially, resulting in a reduced risk of default or non-payment.

Examples of Vehicle Cost Implications

- A sports car, with its often higher value and potential for damage, may have a premium 20-40% higher than a comparable sedan.

- SUVs, often heavier and larger, may have premiums 10-20% higher than comparable sedans due to potential for greater damage in accidents.

- Older vehicles, often less expensive, might have higher premiums due to potential for damage or repair costs.

Impact of Age, Gender, and Location on Premiums

Insurance companies use various factors to assess risk. While not all data is readily available for public consumption, the following table provides a simplified illustration of how age, gender, and location might influence premiums, keeping in mind this is not a definitive or absolute representation.

| Factor | Impact on Premium (Illustrative Example) |

|---|---|

| Age (Young Drivers) | Higher premiums due to a perceived higher accident risk. |

| Age (Older Drivers) | Lower premiums, typically, due to reduced accident risk. |

| Gender | Potential differences in premiums based on historical data of accident rates between genders, though these differences may be narrowing. |

| Location (Urban Areas) | Potentially higher premiums due to increased accident and theft rates in some urban areas. |

| Location (Rural Areas) | Potentially lower premiums, compared to high-density urban areas. |

Strategies for Finding Affordable Quotes: Compare Auto Insurance Quotes In Texas

Source: 4autoinsurancequote.com

Securing competitive auto insurance rates in Texas requires a strategic approach. Understanding the factors influencing premiums and employing effective comparison methods are crucial for finding the most affordable coverage. This section Artikels various strategies for obtaining competitive quotes and maximizing potential discounts.Finding the right auto insurance coverage involves more than just picking the first quote you see. A proactive and informed approach will yield the most favorable rates.

Comparing Multiple Quotes

Obtaining multiple quotes from different insurance providers is fundamental to securing the most competitive rates. Insurance companies often employ different pricing models, and a comprehensive comparison across various providers is essential. This approach allows you to assess the relative costs of comparable coverage packages. For example, Company A might offer a lower premium for comprehensive coverage while Company B might have a lower premium for liability-only coverage.

Leveraging Discounts

Various discounts can significantly reduce your auto insurance premiums. Taking advantage of available discounts can result in substantial savings. Understanding and utilizing these discounts can substantially lower your overall insurance costs.

- Good Student Discounts: Many insurance companies offer reduced rates for students with a good academic record. These discounts recognize the reduced risk associated with students who maintain a high level of academic performance and responsible driving habits.

- Safe Driver Discounts: Insurers often provide discounts for drivers with a clean driving record. These discounts reflect the lower risk associated with safe drivers who have avoided accidents and traffic violations.

- Multi-Policy Discounts: Insurers frequently offer discounts for customers who have multiple insurance policies with the same company. This reflects a reduced administrative burden for the insurance provider.

- Bundling Discounts: Some insurers offer discounts for customers who bundle their insurance needs (auto, home, life). This bundle discounts demonstrate the value proposition of having all insurance needs managed with one provider.

Negotiating with Insurance Providers

While not always possible, negotiating with insurance providers can sometimes yield favorable results. Direct communication and expressing interest in various options might lead to a revised quote. For instance, if a driver demonstrates a lower-risk profile through safe driving and claims history, they may be able to negotiate a lower premium.

Utilizing Online Comparison Tools

Online comparison tools are invaluable resources for finding competitive auto insurance quotes. These platforms allow you to quickly compare rates from multiple providers, saving significant time and effort. These tools simplify the process of obtaining multiple quotes from different insurers.

Tips for Evaluating Quotes

Source: cloudinary.com

Comparing auto insurance quotes in Texas can feel overwhelming. Understanding the key elements and evaluating the terms and conditions of each quote is crucial to finding the best possible deal. This section provides specific methods for evaluating insurance quotes, highlighting key aspects to consider and offering illustrative examples.Evaluating insurance quotes effectively is essential to securing the most suitable coverage at a competitive price.

Careful scrutiny of the terms and conditions is vital, enabling informed decision-making and cost savings.

Key Elements to Look For

Thorough examination of the fine print within each auto insurance quote is critical to making an informed choice. The details of coverage, policy exclusions, and cost structures are critical factors.

- Deductibles: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Lower deductibles generally mean lower premiums, but you’ll pay more out-of-pocket if you file a claim. For example, a $500 deductible will result in lower monthly premiums than a $1000 deductible, but you will pay $500 more upfront in the event of a claim.

- Coverage Limits: Coverage limits define the maximum amount your insurance company will pay in the event of an accident or other covered loss. Carefully review liability coverage limits (e.g., bodily injury and property damage), collision, comprehensive, and uninsured/underinsured motorist coverage. A policy with higher coverage limits protects you more thoroughly but comes at a higher premium cost.

- Policy Exclusions: Insurance policies often have exclusions, which are situations or circumstances where coverage is not provided. Review the policy exclusions carefully to understand what isn’t covered. For instance, some policies exclude coverage for damage caused by war or intentional acts.

- Premium Costs: Assess the total cost of the policy, factoring in all coverage elements and deductibles. Comparing premium costs across different providers is vital to finding the best value.

Sample Policy Comparison

A table showcasing varying auto insurance policy options and their corresponding costs in Texas can help illustrate the diverse choices available. It is important to remember that these figures are examples and actual costs may vary.

| Policy Option | Deductible | Liability Limits | Comprehensive Coverage | Premium (Monthly) |

|---|---|---|---|---|

| Basic Coverage | $500 | $25,000/$50,000 | $500 | $150 |

| Enhanced Coverage | $1000 | $100,000/$300,000 | $1000 | $200 |

| Luxury Coverage | $2000 | $300,000/$500,000 | $2000 | $250 |

Coverage Options and Costs, Compare auto insurance quotes in texas

Different coverage options cater to varying needs and budgets. Understanding the different coverage options available and their associated costs is essential.

- Liability Coverage: This covers the damages you cause to another person or their property in an accident. A higher liability coverage limit will provide more financial protection in case of an accident. For example, a policy with $100,000/$300,000 liability coverage provides $100,000 for injuries to one person and $300,000 for injuries to multiple people in a single accident.

- Collision Coverage: Collision coverage pays for damages to your vehicle if it’s involved in a collision, regardless of who is at fault. The cost of this coverage depends on the vehicle’s make, model, and value.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle from damage caused by events other than collisions, such as vandalism, theft, or weather-related events. The premium cost depends on factors like the vehicle’s value and the coverage limits chosen.

Navigating the Insurance Application Process

Securing the right auto insurance in Texas involves more than just comparing quotes. A smooth application process is equally crucial for a positive experience and a swift approval. Understanding the steps and required documentation ensures a straightforward application journey.The application process for auto insurance in Texas, while generally straightforward, requires attention to detail and accuracy. Each step, from gathering necessary documents to submitting the completed application, contributes to a smooth process and a prompt response from the insurer.

Steps Involved in Completing an Auto Insurance Application

The process typically involves several steps. First, gather the required documentation. Next, complete the online application form or, if required, a paper application. Finally, submit the completed application and supporting documents.

Common Documents Required for the Application

Accurate and timely submission of required documents is essential for a smooth application process. This usually involves providing personal information, vehicle details, and potentially driving history. Commonly required documents include:

- Proof of Identity: Driver’s license, state-issued ID card, or passport.

- Proof of Vehicle Ownership: Vehicle title or registration.

- Proof of Address: Utility bill, bank statement, or lease agreement (within the last 30 days).

- Driving History: Information from the Department of Public Safety (DPS) is often required, which may include accident reports or traffic violations.

- Previous Insurance Information: Details of any previous insurance policies, including policy numbers and dates of coverage.

Importance of Accuracy in Providing Information

Inaccurate information during the application process can lead to delays or even denial of coverage. Providing accurate details is critical for obtaining the correct premium calculation and avoiding complications later on. This accuracy also helps the insurance company make informed decisions about your risk profile.

Submitting an Auto Insurance Application Online

Many insurers offer online application portals. These portals typically guide you through the process, providing clear instructions and fields for each required item. You can typically upload the necessary documents digitally. Submitting the application online can be a convenient and efficient way to secure coverage.

- Account Creation: Create an account on the insurance company’s website, which will store your details and streamline future interactions.

- Application Completion: Fill out the application form with accurate and complete information, ensuring you have the required documents handy.

- Document Upload: Upload the requested documents, ensuring they are clearly legible and in the correct format.

- Review and Submission: Thoroughly review the application and attached documents before submitting it to confirm accuracy. Some insurers provide a checklist to verify completeness.

- Confirmation: After submission, you should receive a confirmation message or email acknowledging the application’s receipt.

Choosing the Right Insurance Provider

Selecting the right auto insurance provider in Texas is crucial for securing affordable and comprehensive coverage. Your choice impacts your financial well-being and peace of mind in the event of an accident or damage to your vehicle. Understanding the factors that influence provider selection empowers you to make an informed decision.Choosing the best insurance provider involves more than just the lowest premium.

It encompasses evaluating the company’s reputation, customer service track record, and financial stability. By considering these aspects, you can ensure that you’re partnering with a reliable company capable of fulfilling its obligations should the need arise.

Key Criteria for Choosing an Insurance Provider

Evaluating insurance providers involves considering several key factors. These criteria are instrumental in identifying a provider aligned with your specific needs and risk tolerance.

- Reputation and Customer Service: A provider’s reputation reflects its past performance and customer interactions. Positive reviews and a strong online presence indicate a commitment to customer satisfaction. Contacting the provider directly to assess response times and the helpfulness of their representatives is also a valuable approach.

- Financial Stability: A financially stable insurance company is essential. This guarantees the provider’s ability to meet its obligations if claims arise. Reviewing the company’s financial strength ratings from independent agencies is crucial.

- Coverage Options: Different providers offer varying coverage options and add-ons. Evaluate if the coverage aligns with your needs, vehicle type, and personal circumstances. Consider factors such as comprehensive coverage, collision coverage, and uninsured/underinsured motorist protection.

- Pricing Strategies: Insurance premiums vary significantly between providers. Compare pricing strategies to identify competitive rates that meet your budget. Look for providers with transparent pricing structures that clearly Artikel the factors influencing premium costs.

Comparing Coverage Options and Pricing Strategies

Insurance providers in Texas employ different pricing strategies. Analyzing these strategies helps in making informed comparisons.

- Premium Structure: Some providers base premiums on factors such as your driving record, vehicle type, and location. Others might include discounts for safe driving or other specific circumstances. Understanding the structure helps to anticipate potential cost variations.

- Coverage Packages: Evaluate different packages offered by various providers. Tailor your selection to match your unique needs and financial capacity. For example, a young driver might need comprehensive coverage, whereas an older driver with a clean record might need more limited coverage. Consider factors such as your vehicle’s age, make, and model, and your personal risk profile.

Provider Ratings and Customer Satisfaction

Analyzing provider ratings and customer satisfaction scores provides insights into the quality of service.

| Insurance Provider | Rating Agency Score (Example) | Customer Satisfaction Score (Example) |

|---|---|---|

| Company A | A+ (from AM Best) | 4.5 out of 5 (based on customer reviews) |

| Company B | A (from AM Best) | 4.2 out of 5 (based on customer reviews) |

| Company C | A- (from AM Best) | 4.0 out of 5 (based on customer reviews) |

| Company D | B+ (from AM Best) | 3.8 out of 5 (based on customer reviews) |

Note: Rating and customer satisfaction scores are examples and should be verified with reliable sources.

Final Summary

In conclusion, securing the most competitive auto insurance quotes in Texas involves a comprehensive approach. Comparing various providers, evaluating coverage options, and understanding the influencing factors are key to making an informed decision. By applying the strategies Artikeld in this guide, you can achieve significant savings and find the ideal auto insurance policy to protect your financial interests.

Question & Answer Hub

What are the typical steps involved in obtaining quotes from various providers using a comparison website?

Typically, comparison websites guide you through providing your vehicle details, driving history, and personal information. This information is then used to generate quotes from multiple providers. You can then compare these quotes based on various factors such as premiums, coverage options, and discounts.

How do credit scores impact auto insurance rates in Texas?

A lower credit score often correlates with higher auto insurance premiums in Texas. Insurance companies use credit scores as a proxy for assessing risk, with better credit scores generally associated with lower premiums.

What are some common documents required for the auto insurance application process?

Common documents often required include proof of identity (driver’s license), proof of vehicle ownership (title and registration), and sometimes a copy of your driving record.

What are the minimum coverage amounts required for auto insurance in Texas?

Texas mandates minimum liability coverage amounts. These amounts vary depending on the type of vehicle (personal vs. commercial). It’s essential to check the specific requirements to ensure compliance with the law.