Compare car insurance rates in Texas to find the best deals. Texas’s insurance market offers a wide range of options, but navigating them can be tricky. This guide will help you understand the factors that influence premiums, compare quotes, and find affordable coverage. We’ll cover everything from the different types of coverage to the latest regulations and resources to assist you in your search for the right insurance plan.

Understanding the Texas car insurance landscape is crucial for making informed decisions. This comprehensive guide delves into the nuances of the market, offering valuable insights into various factors impacting your premiums. From your driving record to the type of vehicle you own, we’ll explore how each aspect contributes to the final cost of your policy.

Introduction to Car Insurance in Texas

Texas car insurance regulations are designed to balance the needs of drivers and the protection of others on the road. This involves a system of required coverages and established procedures for claims and disputes. The state’s framework sets a baseline for financial responsibility, but individual policies can vary significantly.Texas drivers must maintain minimum liability insurance coverage, protecting others in the event of an accident.

Beyond these minimums, many drivers opt for additional coverage for broader protection. Understanding the available coverage options and factors influencing premiums is key to selecting a policy that best meets individual needs and budget.

Types of Car Insurance Coverage in Texas

Texas law mandates specific coverages, but drivers often purchase additional protection. Liability insurance is required and covers damages to others in the event of an accident. This is categorized into bodily injury liability (BI) and property damage liability (PD). Collision coverage pays for damages to your vehicle regardless of who caused the accident, while comprehensive coverage protects your vehicle from non-collision incidents like vandalism, fire, or theft.

Factors Influencing Car Insurance Premiums in Texas

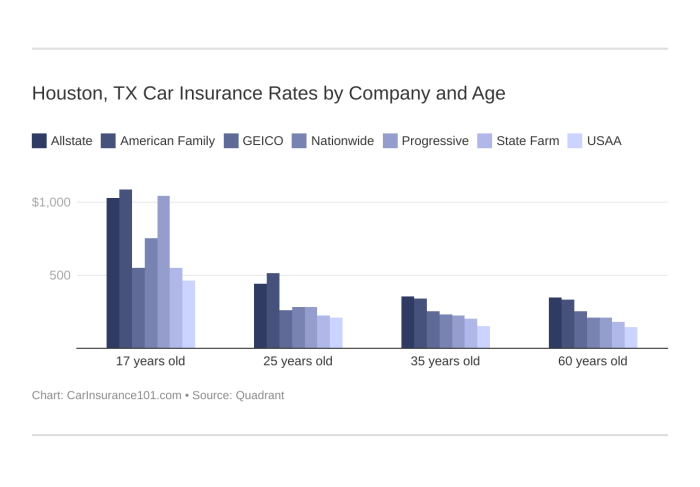

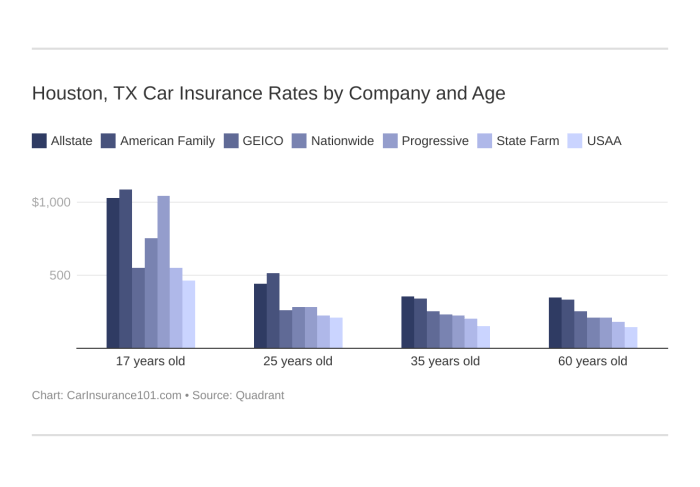

Several factors play a role in determining car insurance premiums in Texas. A driver’s driving record, including any accidents or traffic violations, is a significant factor. Vehicles with higher theft risks, such as luxury models, will typically have higher premiums. Location also influences premiums, as some areas experience a higher frequency of accidents or claims. Additionally, factors like age and credit history can also impact premiums, although these may vary from company to company.

Comparison of Typical Coverage Levels, Compare car insurance rates in texas

| Insurance Company | Liability (Bodily Injury) | Liability (Property Damage) | Collision | Comprehensive |

|---|---|---|---|---|

| Example Company 1 | $30,000 per person, $60,000 per accident | $25,000 per accident | $100,000 | $50,000 |

| Example Company 2 | $25,000 per person, $50,000 per accident | $20,000 per accident | $75,000 | $25,000 |

| Example Company 3 | $50,000 per person, $100,000 per accident | $25,000 per accident | $150,000 | $75,000 |

Note: These are example figures and actual coverage levels may vary significantly depending on specific policy details, discounts, and other factors. Always review the policy details with the insurance provider.

Comparing Car Insurance Quotes

Source: tgsinsurance.com

Getting the best car insurance rates in Texas involves more than just a quick online search. Understanding the process and the factors influencing premiums is key to securing the most favorable policy. A thorough comparison of quotes from various providers is essential for informed decision-making.Comparing quotes is crucial for finding the most affordable coverage while meeting your specific needs.

This involves understanding the methods insurance companies use to calculate premiums and the various tools available to simplify the process. By evaluating quotes carefully, you can identify the best option for your financial situation and protection.

Steps to Obtain Multiple Quotes

Obtaining multiple car insurance quotes in Texas typically involves several steps. First, gather the necessary information about your vehicle, driving history, and personal details. This includes your vehicle’s year, make, model, and any safety features. Your driving record, including any accidents or traffic violations, is also important. Finally, your personal information, such as your age, location, and any prior insurance claims, will also affect the quotes.Once you have this information, you can start contacting insurance providers directly or use online comparison tools.

Be sure to compare quotes from different companies to identify the best value for your needs.

Online Quote Comparison Tools

Numerous online platforms specialize in providing car insurance quotes. These tools simplify the process by aggregating quotes from various insurers. This allows you to quickly compare policies and rates from multiple providers in one place. Examples of popular online quote comparison tools include [insert a list of 3-5 popular comparison websites]. These sites often allow you to input your information once and receive quotes from multiple companies.These websites frequently use algorithms to match your information with relevant policies.

The results presented are usually tailored to your specific circumstances, considering your location, vehicle details, and driving record. However, it is essential to review the specific features and limitations of each tool before making a final decision.

Insurance Premium Calculation Methodologies

Insurance companies use a variety of factors to calculate premiums. These factors often include:

- Driving record: A clean driving record generally results in lower premiums. Accidents and traffic violations significantly increase premiums.

- Vehicle type and features: The type of vehicle, its age, and safety features play a role in the premium. Vehicles with advanced safety features tend to have lower premiums.

- Location: Your location in Texas can influence your premiums. Areas with higher accident rates or crime often have higher premiums.

- Personal factors: Your age, gender, and credit history are also considered by some insurers when determining premiums. In some cases, a lower credit score can result in a higher premium.

- Coverage choices: The level of coverage you select directly impacts the cost of your policy. Higher coverage levels typically lead to higher premiums.

Comparison of Quote Comparison Tools

This table summarizes the key features, advantages, and disadvantages of different quote comparison tools.

| Tool | Features | Pros | Cons |

|---|---|---|---|

| QuoteTool1 | Comprehensive search, detailed policy comparison, multiple insurer options | Wide range of options, detailed comparison | May have limited local insurer options |

| QuoteTool2 | User-friendly interface, fast quote retrieval, tailored recommendations | Easy to use, quick results, personalized recommendations | May not offer the most comprehensive coverage options |

| QuoteTool3 | Focus on specific types of insurance (e.g., teen drivers, luxury vehicles), detailed coverage breakdowns | Specialized services, detailed coverage | May have fewer overall insurer options |

| QuoteTool4 | Customizable search filters, advanced comparisons | Tailored searches, in-depth analysis | Interface may be complex for some users |

| QuoteTool5 | Integrates with other financial services, discounts | Convenience, potential for bundled discounts | May not offer the widest range of insurers |

Factors Affecting Car Insurance Rates in Texas

Car insurance premiums in Texas, like elsewhere, are not a fixed amount. Numerous factors influence the cost of your policy, making it essential to understand these elements to get the best possible rate. This understanding empowers you to make informed decisions and potentially save money on your car insurance.The factors that shape your car insurance rates are multifaceted and often interconnected.

Understanding these elements is key to getting the most competitive rates possible. These factors aren’t arbitrary; they’re carefully considered by insurance companies to assess risk and accurately price policies.

Age and Driving History

Insurance companies closely scrutinize a driver’s age and driving history when determining premiums. Younger drivers are typically considered higher-risk due to a perceived lack of experience and potentially higher accident rates. Conversely, older drivers with a clean driving record often qualify for lower premiums. Driving history includes not just accidents but also traffic violations. For example, a driver with multiple speeding tickets might see a significant increase in their premium compared to someone with a spotless record.

Vehicle Type and Value

The type of vehicle you drive plays a significant role in your insurance premium. High-performance sports cars and luxury vehicles are generally more expensive to insure than smaller, more economical models. This is due to the higher repair costs associated with damage to these vehicles. The value of the car also affects the premium, as a higher-value car requires more comprehensive coverage, increasing the cost.

For instance, a vintage sports car or a high-end luxury SUV will likely command a higher premium compared to a standard sedan.

Location and Coverage

Geographic location is a critical factor in car insurance rates. Areas with higher rates of accidents or theft tend to have higher premiums. This is often due to the frequency of accidents, crime rates, or the type of roads. Additionally, the type of coverage you select will directly impact your premium. For example, a policy with a higher deductible will result in a lower premium, but you’ll have to pay more out of pocket in the event of a claim.

Likewise, comprehensive coverage, which protects against damage not caused by accidents, adds to the cost. Factors like weather patterns and road conditions in the area also affect insurance rates.

Credit Score

Insurance companies often consider your credit score as an indicator of your financial responsibility. A lower credit score might result in a higher premium. This is because a poor credit score can suggest a higher risk of defaulting on financial obligations, which insurance companies use to assess the risk of a potential claim. A good credit score demonstrates financial responsibility and can lead to lower insurance premiums.

Discounts Available in Texas

Discounts can significantly lower your car insurance costs. Many insurance companies offer various discounts for drivers who meet specific criteria. Understanding the available discounts can lead to substantial savings. The following are some common discounts offered by Texas insurance providers.

- Multi-Policy Discounts: Bundling multiple insurance policies (such as auto, homeowners, or renters) with the same provider often results in discounts. This demonstrates a commitment to the company and a reduction in their administrative burden.

- Good Student Discounts: Drivers enrolled in a high school or college program often qualify for a good student discount. This reflects the lower risk associated with drivers who maintain good academic performance and a lower risk profile.

- Safe Driver Discounts: Drivers with a clean driving record and a history of safe driving habits often qualify for safe driver discounts. This discount recognizes the lower risk associated with these drivers.

- Defensive Driving Courses: Completing a defensive driving course can often earn drivers a discount on their insurance premium. This reflects the commitment to improving driving skills and safety practices.

- Anti-theft Devices: Installing anti-theft devices in your vehicle can often qualify you for discounts. This demonstrates a commitment to protecting your vehicle from theft and reflects a lower risk.

Tips for Finding Affordable Car Insurance

Securing affordable car insurance in Texas involves a strategic approach. Understanding the factors that influence premiums and employing effective comparison methods are crucial. This section details practical strategies to navigate the process and achieve cost-effective coverage.

Comparing Rates from Multiple Providers

A crucial step in securing affordable car insurance is comparing rates from various insurance providers. Texas boasts a competitive insurance market, allowing for diverse options. By comparing quotes from multiple companies, you can identify the most suitable coverage at the best price. This proactive approach can lead to substantial savings.

Strategies to Lower Your Car Insurance Premium

Several strategies can help reduce your car insurance premium. Implementing these methods can result in significant cost savings.

- Maintaining a Good Driving Record: A clean driving record, free from accidents and traffic violations, is paramount. Insurance companies often reward safe drivers with lower premiums. For instance, drivers with clean records often receive discounted rates, potentially saving hundreds of dollars annually.

- Utilizing Discounts: Many insurance companies offer discounts for various factors, such as defensive driving courses, anti-theft devices, and multiple-vehicle insurance. Actively seeking and utilizing these discounts can yield significant savings. For example, a driver who completes a defensive driving course may be eligible for a 5% discount on their premium.

- Bundling Insurance Policies: Bundling your car insurance with other insurance policies, like homeowners or renters insurance, can sometimes lead to discounted rates. This can be a beneficial approach for consolidating coverage and potentially lowering overall insurance costs.

- Raising Your Deductible: Increasing your deductible can often lead to a lower premium. This strategy involves accepting a higher out-of-pocket expense in case of a claim, in exchange for lower monthly payments. However, it’s essential to weigh the potential savings against the increased financial risk.

Resources for Comparing Car Insurance Rates in Texas

Numerous resources can assist in comparing car insurance rates in Texas. Utilizing these resources can simplify the process and ensure you secure the most favorable coverage.

- Online Comparison Tools: Online comparison websites allow you to input your details and receive quotes from various insurance providers. These tools can streamline the process, making it easier to compare different options.

- Insurance Agents: Consulting with an independent insurance agent can provide personalized guidance and assistance in comparing rates. Agents can leverage their expertise to find the most suitable policy for your needs and budget.

- Local Insurance Providers: Exploring local insurance providers can offer insights into tailored options. Their understanding of the local market may provide more specific and advantageous coverage for the area.

Understanding Texas Insurance Regulations: Compare Car Insurance Rates In Texas

Navigating the world of car insurance can feel complex, especially when dealing with specific state regulations. Understanding Texas insurance laws and regulations is crucial for making informed decisions about your coverage and for ensuring you’re compliant with the law. This section will delve into key aspects of Texas insurance, including coverage limits, deductibles, and the claim filing process.Texas insurance regulations are designed to protect both drivers and insurers.

These laws Artikel minimum requirements for liability coverage, ensuring that drivers have adequate protection if they’re involved in an accident. Understanding these rules can help you select the right coverage and avoid potential financial pitfalls.

Texas Minimum Liability Requirements

Texas law mandates specific minimum liability coverage requirements for all drivers. These requirements help to ensure that individuals involved in accidents have sufficient financial protection. Failure to maintain the minimum coverage level can result in legal consequences. These requirements protect both the injured party and the insurance company.

- Bodily injury liability coverage: Texas mandates a minimum coverage of $30,000 per person and $60,000 per accident for bodily injury.

- Property damage liability coverage: The minimum property damage liability coverage required in Texas is $25,000.

Coverage Limits and Deductibles

Understanding your coverage limits and deductibles is vital for effectively managing financial risks. Coverage limits define the maximum amount your insurer will pay for damages in a covered event, while deductibles represent the amount you’ll pay out-of-pocket before your insurer steps in. Knowing these details is essential for anticipating potential costs.

- Coverage limits: It’s important to review your policy and understand the specific limits of your coverage for various types of claims (e.g., medical expenses, property damage, lost wages). Choosing appropriate coverage limits is vital for ensuring sufficient protection.

- Deductibles: Your deductible will affect how much you pay upfront for a claim. A higher deductible often means lower premiums, but you’ll be responsible for a larger sum in the event of an accident.

Filing a Claim in Texas

The claim filing process varies depending on the specific insurance company. However, common steps typically include reporting the accident to your insurer, providing necessary documentation, and cooperating with any investigation. Prompt and accurate reporting is crucial for a smooth claims process.

- Reporting the accident: Contact your insurance company as soon as possible after an accident to report the incident. Be prepared to provide details about the accident, including the time, location, and involved parties.

- Gathering documentation: Gather all relevant documents, such as police reports, medical records, and repair estimates, to support your claim.

- Cooperating with investigations: Cooperate fully with any investigation conducted by your insurance company.

Resources for Understanding Texas Car Insurance Regulations

Several resources can assist you in understanding Texas car insurance regulations.

- Texas Department of Insurance (TDI): The TDI website provides comprehensive information on Texas insurance laws and regulations. This is a crucial resource for anyone looking for official guidelines.

- Texas Insurance Commissioner: The Texas Insurance Commissioner’s office provides information about insurance companies and their operations.

- Local Insurance Agents: Consulting a local insurance agent can provide tailored guidance and explain specific aspects of your coverage.

Illustrative Examples of Insurance Costs

Car insurance premiums in Texas, like many other states, are influenced by a variety of factors. Understanding how these elements combine to affect your cost is crucial for making informed decisions about your coverage. This section provides illustrative examples to clarify the impact of different variables on your insurance policy.

Sample Scenario: Impact of Factors on Costs

Consider a 25-year-old driver in Austin, Texas, with a clean driving record, owning a 2020 Honda Civic. Their insurance costs are affected by several elements. A good driving record results in lower premiums. If this same driver had a minor accident in the past year, premiums would likely be higher due to increased risk assessment by the insurer.

Their vehicle type, a compact car, typically results in lower premiums compared to larger vehicles like SUVs. Living in a city like Austin, known for higher accident rates compared to rural areas, could slightly increase the premium. These factors interact to determine a specific premium.

Examples of Discounts Impacting Premiums

Discounts can significantly reduce your car insurance costs. For example, a driver who maintains a safe driving record, demonstrating a history of accident-free driving, may qualify for a substantial discount. Drivers who have taken defensive driving courses can also receive discounts, reflecting their commitment to safer driving habits. Bundling insurance policies, such as combining car insurance with home insurance, can also lead to a discount, leveraging the relationship between multiple policies from the same insurance provider.

Comparison of Insurance Premiums by Vehicle Type

The type of vehicle you drive often plays a crucial role in your car insurance premium. Different vehicles carry varying levels of risk, impacting the insurer’s assessment of liability and potential damages in accidents. This table provides a general illustration of how different vehicle types may affect premiums.

| Vehicle Type | Estimated Premium (Annual) |

|---|---|

| Compact Car | $1,200 |

| SUV | $1,500 |

| Luxury Sports Car | $1,800 |

Note: These are estimated premiums and can vary based on individual circumstances, including driving history, location, and coverage options. Factors like the specific make and model of the vehicle, as well as the driver’s age and location, can also influence the premium.

Navigating Insurance Claims

Filing a car insurance claim in Texas can be a straightforward process, but understanding the steps and potential challenges is crucial. This section details the claim process, common scenarios, and how to handle potential denials. Thorough documentation is key to a smooth and successful claim resolution.

The Claim Filing Process

Understanding the specific steps in filing a claim ensures a smoother process. Insurance companies typically require specific information and documentation to process claims effectively. A clear understanding of the company’s claim procedures, including deadlines and required forms, is essential.

- Initial Report: Immediately report the accident to the police, even if the damage seems minor. Gather contact information for all parties involved, including witnesses. Obtain a police report, which often contains valuable details about the accident.

- Contact Your Insurance Company: Notify your insurance company as soon as possible after the accident. Provide them with the necessary information, including the details of the accident, the involved parties, and any injuries sustained.

- Gather Documentation: Compile all relevant documents, such as the police report, medical records (if applicable), repair estimates, and witness statements. Photograph the damage to your vehicle and any other property involved.

- Filing the Claim Form: Complete the claim form provided by your insurance company, ensuring accurate and complete information. Submit the form along with all supporting documentation.

Claim Scenarios and Resolution

Various claim scenarios require different approaches. Here are some examples:

- Minor Damage: For minor damage, the insurance company might offer a direct repair estimate and approval. If you opt for a repair shop, the company may require the shop’s contact details and estimate.

- Total Loss: In a total loss situation, the insurance company will assess the vehicle’s value and offer a settlement. You may need to provide an appraisal or documentation to support the claim.

- Third-Party Liability: If the accident is due to another driver’s negligence, your insurance company will pursue compensation from the at-fault party’s insurance. This process can involve negotiations and potential litigation.

- Uninsured/Underinsured Motorist Coverage: If the at-fault driver has no insurance or insufficient coverage, your uninsured/underinsured coverage will provide compensation for your losses. This coverage often requires specific documentation and adherence to policy requirements.

Understanding and Managing Claim Denials

Insurance companies may deny claims for various reasons. Understanding these reasons and how to address them is crucial.

- Reviewing the Denial Notice: Carefully review the denial notice to understand the specific reason for the denial. Identify any missing documentation or inaccuracies in the claim.

- Appealing the Denial: If you disagree with the denial, appeal the decision with supporting documentation and evidence. Address the specific concerns Artikeld in the denial notice.

- Seeking Professional Assistance: Consider consulting with a legal professional if you are facing a complex or contested claim denial. An attorney can help you navigate the legal aspects and potentially appeal the denial successfully.

The Importance of Documentation

Thorough documentation is critical in insurance claims.

- Evidence of Damage: Photographs and videos of the damage are crucial. These records help substantiate the extent of the damage.

- Medical Records: Medical records for any injuries sustained are necessary, especially if seeking compensation for medical expenses.

- Police Reports: A police report provides a formal record of the accident and the involved parties, acting as vital evidence.

- Repair Estimates: Estimates from qualified repair shops demonstrate the cost of repairing the damage to your vehicle. Accurate repair estimates are important.

Final Wrap-Up

Source: carinsurance101.com

In conclusion, comparing car insurance rates in Texas is a vital step in securing the right coverage at a competitive price. By understanding the factors influencing premiums, comparing quotes effectively, and staying informed about Texas regulations, you can find affordable and suitable insurance. This guide provides a roadmap for navigating the Texas insurance market, empowering you to make well-informed decisions about your auto insurance needs.

Question & Answer Hub

What are the most common discounts available in Texas?

Common discounts include multi-policy discounts, good student discounts, and safe driver discounts. Other discounts may be offered by individual insurance companies.

How do credit scores impact car insurance premiums?

While not always a direct factor, insurers sometimes consider credit scores as an indicator of risk. A lower credit score may lead to a higher premium.

What resources are available to compare car insurance quotes in Texas?

Online quote comparison tools and websites are commonly used, as well as independent comparison services. Check with local agents for additional options.

What are the key regulations to consider when purchasing car insurance in Texas?

Texas regulations mandate minimum liability coverage. Understanding these requirements, along with your specific needs and coverage limits, is crucial.

How can I file a claim with my Texas car insurance company?

Contact your insurance company directly for specific claim procedures. Gather all necessary documentation, and follow the instructions provided.