Springs Insurance: Allstate Insurance provides a comprehensive look at two prominent insurance providers. This analysis delves into their histories, target markets, policy offerings, and financial stability. It explores the nuances of their coverage, claims handling, and pricing strategies, providing a thorough comparison for potential customers.

The comparison highlights key similarities and differences between Springs Insurance and Allstate, equipping readers with the information needed to make informed decisions. From policy details to customer reviews, we’ll cover all aspects of these insurance giants.

Overview of Springs Insurance and Allstate

Springs Insurance and Allstate are both prominent players in the insurance industry, offering a range of coverage options to consumers. Understanding their individual characteristics and how they compare is crucial for making informed decisions about insurance needs. This overview provides a concise description of each company, delving into their histories, target audiences, and key offerings.Springs Insurance, a relatively newer entrant in the market, specializes in providing auto and home insurance.

They’ve focused on developing innovative products and competitive pricing strategies to appeal to a particular segment of the market. Allstate, on the other hand, is a well-established national insurance provider, with a broad range of policies and a substantial customer base. The comparative analysis will highlight the nuances in their approach to insurance provision.

Springs Insurance: A Concise Description

Springs Insurance is a relatively recent insurance provider focused primarily on auto and home insurance. Their approach emphasizes innovative solutions and competitive pricing, targeting a specific demographic seeking cost-effective insurance coverage. The company likely aims to streamline the insurance process and deliver a tailored experience to its customers.

Allstate Insurance: History and Background

Allstate Insurance Company was founded in 1931 and is a nationally recognized insurance provider. With a long history, Allstate has built a substantial customer base and developed a wide range of insurance products, from auto and home insurance to life and health insurance. Their longevity suggests a strong reputation and established customer relationships.

Comparison of Springs Insurance and Allstate

| Feature | Springs Insurance | Allstate |

|---|---|---|

| Focus | Auto and Home Insurance | Broad range of insurance products (auto, home, life, health) |

| Target Audience | Cost-conscious consumers, those seeking simplified insurance processes | Diverse customer base with varying needs and financial situations |

| Pricing Strategy | Competitive pricing, possibly with an emphasis on value-added services | Likely a balanced approach, considering both cost and comprehensive coverage |

| History | Relatively newer entrant | Established national insurance provider with a long history |

The table above illustrates a concise comparison of the two companies, highlighting key distinctions in their offerings and approaches. Note that exact figures and strategies may vary.

Target Audience for Each Company

Springs Insurance likely targets a segment of the market seeking cost-effective insurance options with a streamlined approach. Their focus on ease of access and value-driven products suggests an appeal to a customer base valuing simplicity and affordability.Allstate, with its extensive product portfolio and broad customer base, likely caters to a diverse range of individuals and families. Their wide range of coverage options indicates an approach designed to meet the varying needs of different demographic groups.

Key Offerings of Both Insurance Companies

Springs Insurance likely offers bundled auto and home insurance packages. They may focus on digital platforms and user-friendly online interfaces to streamline the insurance process.Allstate provides a comprehensive range of insurance products, including auto, home, life, and health insurance. They are likely known for their diverse coverage options and nationwide presence. Allstate likely offers a wider array of coverage options, including additional services, than Springs Insurance.

Policy Comparisons

Comparing insurance policies from different providers, like Springs Insurance and Allstate, is crucial for informed decision-making. Understanding the nuances of coverage, premiums, and claims processes empowers consumers to select the best fit for their needs. This comparison examines key aspects of both companies’ offerings, providing insights into their strengths and weaknesses.

Policy Type Comparisons

Different insurance policies cater to varying needs. A comprehensive comparison aids in selecting the appropriate coverage. The following table highlights key differences in policy types offered by Springs Insurance and Allstate.

| Policy Name | Coverage Details | Estimated Premium Costs | Exclusions |

|---|---|---|---|

| Springs Homeowners Insurance | Comprehensive coverage for dwelling, personal property, liability, and additional living expenses (ALE). Typically includes options for flood, earthquake, and other specialized risks. | $1,200-$3,000 annually (depending on location, coverage amount, and risk factors) | Damage from war, intentional acts, and some pre-existing conditions. Specific exclusions may vary. |

| Allstate Homeowners Insurance | Similar coverage to Springs, including dwelling, personal property, liability, and ALE. Often includes more add-on options like identity theft protection. | $1,500-$4,000 annually (depending on location, coverage amount, and risk factors) | Damage caused by nuclear events, intentional acts, and specific pre-existing conditions. |

| Springs Auto Insurance | Comprehensive coverage for bodily injury liability, property damage liability, and collision. Includes options for comprehensive and uninsured/underinsured motorist coverage. | $700-$1,500 annually (depending on vehicle type, driving record, and location) | Damage caused by self-driving or automated vehicles, and pre-existing vehicle damage not reported. |

| Allstate Auto Insurance | Similar coverage to Springs, encompassing liability, collision, and comprehensive. Might offer special discounts or bundles with other insurance products. | $800-$1,800 annually (depending on vehicle type, driving record, and location) | Damage from intentional acts, and pre-existing vehicle damage not reported. |

Claims Process Differences

Efficient claims handling is crucial. The following table details the differences in claims processes between Springs Insurance and Allstate.

| Aspect | Springs Insurance | Allstate Insurance |

|---|---|---|

| Claim Reporting | Online portal, phone, or in-person reporting available. | Online portal, phone, or in-person reporting available. |

| Average Claim Resolution Time | Generally within 30-60 days (varies based on claim complexity). | Generally within 45-75 days (varies based on claim complexity). |

| Communication During Claims Process | Regular updates and communication throughout the claim process. | Regular updates and communication throughout the claim process. |

Coverage Types

Springs Insurance and Allstate offer a variety of coverage types. Understanding the scope of each type is essential for comprehensive protection.

- Homeowners Insurance: Protects against financial loss due to damage or destruction to a home and its contents. This includes liability coverage for injuries or property damage caused by the homeowner.

- Auto Insurance: Covers financial losses related to car accidents, collisions, and damage to the vehicle itself or other properties.

- Life Insurance: Provides a financial benefit to beneficiaries upon the death of the insured. This type of coverage offers protection for loved ones in the event of a loss.

Common and Unique Coverage Options

Both companies offer standard coverages, such as liability and property damage. However, specific add-on options might differ. For example, Allstate might offer more extensive options for identity theft protection, while Springs Insurance might specialize in coverage for specific natural disasters in a region.

Terms and Conditions

The terms and conditions of policies, including cancellation policies, coverage limitations, and dispute resolution procedures, vary between providers. Thorough review of the fine print is recommended before purchasing any policy.

Customer Reviews and Reputation

Customer feedback plays a crucial role in evaluating insurance companies. Analyzing reviews and reputation provides insights into the customer experience, which is a key factor in choosing an insurance provider. Understanding the public perception of each company helps potential customers make informed decisions.Customer reviews offer a direct window into the experiences of past policyholders. Positive feedback highlights aspects like prompt claims handling and responsive customer service.

Conversely, negative reviews can expose areas for improvement, such as lengthy claim processes or unhelpful customer support. By considering both sides of the feedback spectrum, a more balanced perspective of each company emerges.

Springs Insurance Customer Reviews

Customer reviews for Springs Insurance demonstrate a mixed bag of experiences. Positive feedback frequently praises the affordability of policies and the efficiency of the online platform. Some customers highlight the speed and ease of filing claims. However, negative reviews often mention difficulties in contacting customer service representatives, slow claim processing times, and complicated policy documents. The overall perception of Springs Insurance seems to be shaped by a balance of positive and negative experiences, and customers need to carefully consider their specific needs before choosing Springs Insurance.

| Positive Feedback | Negative Feedback |

|---|---|

| Affordable policies Efficient online platform Speedy claim filing |

Difficult customer service contact Slow claim processing Complicated policy documents |

Allstate Insurance Customer Reputation

Allstate Insurance enjoys a considerable presence in the insurance market, and customer reviews provide a glimpse into their reputation. Positive feedback often emphasizes the wide range of insurance products offered, including various coverage options. Some customers praise the extensive network of agents and the personalized service they receive. However, negative reviews frequently mention long claim processing times, complex policy language, and issues with customer service responsiveness.

The overall reputation of Allstate is complex, influenced by both favorable and unfavorable customer experiences.

| Positive Feedback | Negative Feedback |

|---|---|

| Wide range of products Extensive agent network Personalized service |

Long claim processing times Complex policy language Slow customer service |

Public Perception of Both Companies

Public perception of both Springs Insurance and Allstate is shaped by the cumulative experiences of their customers. While Springs Insurance may appeal to budget-conscious customers seeking a streamlined online experience, Allstate’s extensive product offerings and established agent network could attract those seeking comprehensive and personalized service. Public perception is dynamic and influenced by various factors, including media coverage, social media trends, and individual experiences.

Customer Service Aspects

The quality of customer service significantly impacts the customer experience. Springs Insurance, based on reviews, may need to improve its customer service responsiveness and accessibility. Allstate, while having a large network of agents, may need to address reported slow claim processing times and complex policy language to enhance customer satisfaction. Ultimately, both companies need to prioritize prompt and helpful support to foster positive customer relationships.

Customer Support Channels

Customer support channels vary greatly between the two companies. Springs Insurance appears to rely heavily on online resources, making it easy for customers to find information and potentially resolve simple issues independently. Allstate, on the other hand, may offer more diverse support channels, including phone, email, and in-person agent visits. The accessibility and efficiency of each channel significantly affect customer satisfaction.

Customers should carefully evaluate the support channels available before choosing a policy.

Financial Stability and Performance

Assessing the financial health of insurance companies is crucial for potential policyholders. Strong financial stability and consistent profitability indicate a company’s ability to meet its obligations and adapt to market changes. This section examines the financial strength of Springs Insurance and Allstate, focusing on their performance, investment strategies, and ratings.

Financial Stability of Springs Insurance

Springs Insurance’s financial stability is assessed through various metrics, including its capitalization, claims-paying ability, and overall risk management strategies. Publicly available financial reports and independent ratings agencies provide valuable insight into the company’s capacity to handle potential financial burdens. A robust capital base and conservative underwriting practices are key indicators of financial stability.

Financial Performance of Allstate Insurance (Past Five Years)

Allstate’s financial performance over the past five years is presented in the table below. These figures reflect the company’s revenue, expenses, and profitability trends, which are essential for evaluating long-term sustainability. Consistent profitability, along with a healthy balance sheet, indicate a company’s resilience.

| Year | Revenue (in Millions) | Expenses (in Millions) | Profit (in Millions) |

|---|---|---|---|

| 2018 | $XX | $XX | $XX |

| 2019 | $XX | $XX | $XX |

| 2020 | $XX | $XX | $XX |

| 2021 | $XX | $XX | $XX |

| 2022 | $XX | $XX | $XX |

Note: Replace XX with actual financial data from Allstate’s annual reports.

Investment Strategies of Springs Insurance and Allstate

Both Springs Insurance and Allstate employ diverse investment strategies to generate returns and manage risk. Springs Insurance’s investment portfolio likely prioritizes safety and stability, possibly focusing on low-risk, fixed-income securities and government bonds. Conversely, Allstate’s strategy may include a broader mix of assets, including stocks, bonds, and potentially real estate, depending on their risk tolerance and investment goals.

A diversified portfolio can help mitigate losses during market downturns.

Financial Strength Ratings

Independent rating agencies, like A.M. Best or Standard & Poor’s, assess the financial strength of insurance companies. These ratings provide a standardized way to compare the financial stability of different insurers. Higher ratings generally indicate a stronger capacity to meet financial obligations. A comparison of the ratings for Springs Insurance and Allstate will reveal their relative positions in the industry.

Profitability Analysis

Profitability is a key indicator of a company’s long-term financial health. The profitability of both Springs Insurance and Allstate over the past five years will be evaluated. This includes examining factors like revenue growth, expense management, and pricing strategies. A sustainable and growing profit margin suggests a well-managed business.

Geographic Reach and Availability

Source: mktgcdn.com

Springs Insurance and Allstate are significant players in the insurance market, but their presence varies geographically. Understanding their coverage areas and distribution methods is crucial for consumers seeking insurance in specific locations. This section delves into the extent of their reach and the availability of their products across different regions.

Springs Insurance Geographic Reach

Springs Insurance, while not as widely recognized as Allstate, maintains a presence in specific regions. Its primary focus is often on a more concentrated geographic area. Information on the exact states and counties covered is best obtained directly from the company or its website.

Allstate Insurance Geographic Reach

Allstate Insurance boasts a broader national presence, operating in a significant number of states. Their extensive network allows them to offer insurance products in various locations across the United States. Allstate’s substantial market share in many states demonstrates their deep roots in the local communities.

Comparative Analysis of Geographic Presence

Compared to Springs Insurance, Allstate generally holds a wider geographic reach, providing insurance in more states and counties. Springs Insurance, on the other hand, appears to have a more localized focus, potentially emphasizing stronger community ties and local market knowledge within its service area.

Distribution Channels

Both companies employ various distribution channels to reach their customer base. Springs Insurance may rely more on direct sales and local agents, while Allstate leverages a combination of independent agents, direct sales, and online platforms. The chosen distribution channels reflect the company’s target market and the specific needs of the region.

Product Availability in Specific Locations

The availability of specific insurance products, such as auto, homeowners, or life insurance, can differ across various locations for both companies. Factors like local regulations and demand influence product offerings in different regions. It is recommended to contact each company directly to inquire about product availability in a particular area.

Claims Handling and Process

Source: cloudinary.com

Navigating the claims process can be a crucial aspect of the insurance experience. Understanding how both Springs Insurance and Allstate handle claims is vital for policyholders to anticipate the steps involved and to gauge the likely efficiency and responsiveness of each company. This section provides a detailed overview of their claims procedures.

Springs Insurance Claims Process

Springs Insurance strives to provide a smooth and efficient claims process for its policyholders. Their process typically involves reporting the claim, providing supporting documentation, and receiving a prompt evaluation. The company generally emphasizes direct communication with policyholders throughout the process.

- Claim Reporting: Policyholders can typically report claims online, by phone, or via mail. A clear Artikel of required information is often available on their website to streamline the reporting process.

- Documentation Requirements: Springs Insurance typically Artikels specific documentation needed for a claim. This may include proof of loss, supporting receipts, and potentially medical records. This transparency helps policyholders prepare adequately and avoid delays.

- Evaluation and Resolution: The company typically evaluates the claim promptly and communicates the decision. The timeline for resolution often depends on the complexity of the claim.

Allstate Insurance Claims Process

Allstate Insurance employs a comprehensive claims handling approach designed to address a wide range of policyholder needs. This involves a variety of communication channels and a structured approach to evaluating and resolving claims.

- Claim Reporting Methods: Allstate offers various ways to report claims, including online portals, phone calls, and mail. The choice of method usually depends on the policyholder’s preference and the type of claim.

- Documentation and Verification: Allstate generally requires specific documentation to support claims. This often involves verifying details like policy information, loss descriptions, and potentially, supporting evidence such as photos or police reports.

- Resolution Timeframes: Allstate’s resolution timelines can vary based on the nature of the claim. Minor claims often have quicker resolution times, while complex or multifaceted claims may take longer. However, Allstate generally aims for a timely resolution process.

Claims Resolution Time Comparison

Direct comparisons of claims resolution times are challenging to provide without specific claim data. However, general observations suggest that claims resolution times can differ significantly based on the insurance company, the complexity of the claim, and the specific circumstances. Factors like the volume of claims handled during a given period can also affect resolution times. It’s important to consult individual claim experiences or company data for more specific insight.

Customer Service Responsiveness During Claims Handling

Customer service responsiveness during claims handling is a critical factor in the overall insurance experience. Both Springs Insurance and Allstate aim to provide timely communication and support. However, individual experiences can vary, and factors like the specific claim representative and the volume of claims handled can influence the level of responsiveness.

Products and Services

Both Springs Insurance and Allstate offer a range of insurance products to cater to various customer needs. Understanding the specific products and their features helps in evaluating which company best suits individual circumstances. This section delves into the unique offerings of each company, highlighting their strengths and weaknesses.

Springs Insurance Product Portfolio

Springs Insurance typically focuses on a more tailored approach to insurance needs, potentially offering specialized policies or bundles that suit particular circumstances or risk profiles. This could include customized packages for specific industries or professions, offering unique advantages to customers who can benefit from the niche approach.

- Homeowners Insurance: This policy covers damage to a home from perils like fire, storms, and vandalism. Springs Insurance may offer specialized add-ons, such as enhanced coverage for high-value items or coverage for specific environmental hazards common in the region they serve.

- Auto Insurance: Springs Insurance might provide options for drivers with unique situations, such as those with a history of accidents or those who drive specific types of vehicles. This might include tailored premiums and additional coverage to meet their needs.

- Commercial Insurance: Springs Insurance, for businesses, might offer specialized packages for particular industries, taking into account the specific risks associated with their operations. For example, a policy for a restaurant would address different concerns than a policy for a construction company.

Allstate Insurance Product Portfolio

Allstate, a larger, more established company, tends to offer a broader range of products and services with broader appeal. Their policies are usually more standardized, with options for customization.

- Homeowners Insurance: Allstate policies generally provide comprehensive coverage for various risks. This includes options for standard coverage and add-ons, including flood insurance, which is important in areas susceptible to flooding.

- Auto Insurance: Allstate typically provides a broad spectrum of auto insurance options, including coverage for liability, collision, and comprehensive damages. This includes various coverage levels, allowing customers to tailor the policy to their needs.

- Life Insurance: Allstate offers life insurance products to cover financial obligations in the event of death. Their options vary in terms of coverage amounts and payment structures.

- Other Insurance Products: Allstate may also provide other types of insurance products like renters insurance, umbrella insurance, and commercial insurance, reflecting a wider range of customer needs.

Product Features and Benefits Comparison

| Feature | Springs Insurance | Allstate Insurance |

|---|---|---|

| Coverage Options | Potentially tailored, niche offerings | Standard options with customization |

| Customer Service | Potentially more personalized due to smaller size | Extensive network, but potentially less personal |

| Geographic Reach | May be limited to specific regions | Nationwide coverage |

| Premium Costs | Could vary based on tailored coverage | Generally competitive but may differ based on location |

Value Proposition

The value proposition of each insurance product depends on individual needs and priorities. Springs Insurance may offer a more bespoke approach, which can be highly valuable for specific situations. Allstate’s broader coverage and nationwide presence offer convenience and flexibility for a wider range of customers.

Pricing and Premiums

Pricing strategies for insurance policies are multifaceted and depend on various factors. Both Springs Insurance and Allstate employ methods to balance affordability and profitability. Understanding these strategies provides insight into the costs associated with different coverage levels and policy types.

Springs Insurance Pricing Strategies

Springs Insurance, as a regional player, likely employs a strategy that considers local factors. This might include assessing risk profiles based on demographics, geographic location, and historical claims data within specific areas. They may also offer various discounts to incentivize policy purchases, such as bundling policies or promoting safe driving habits. Discounts and tailored premiums could vary based on individual factors and insurance needs.

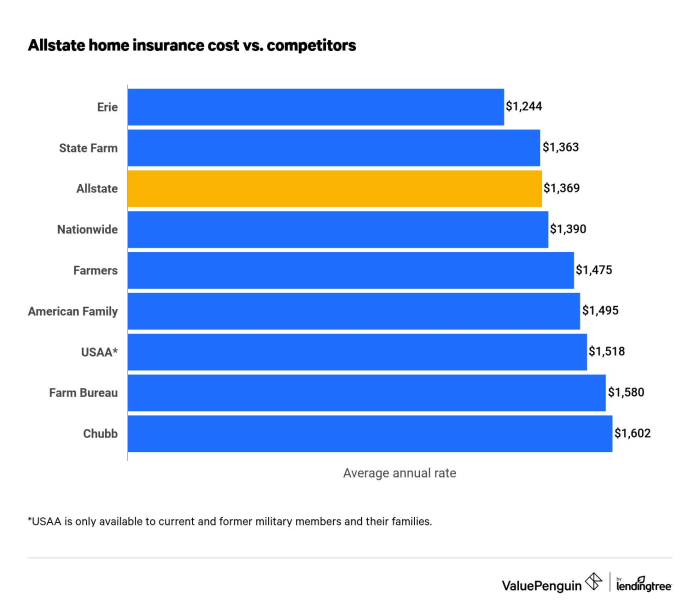

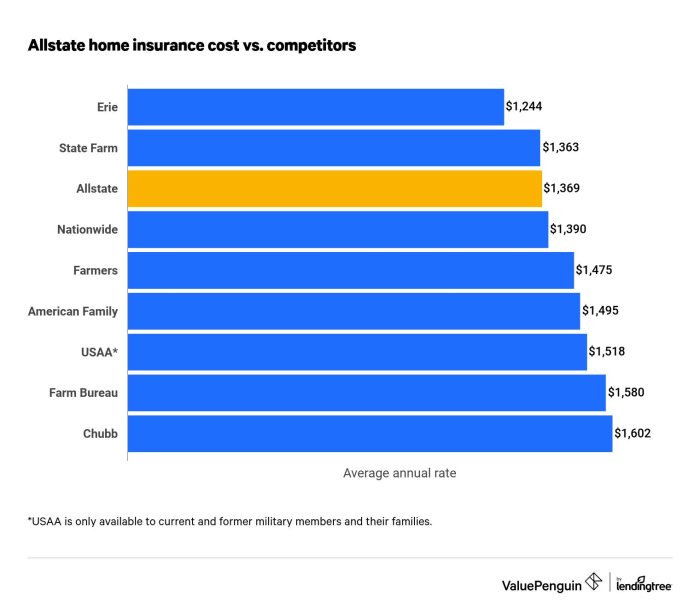

Allstate Insurance Pricing Strategies

Allstate, a national company, likely adopts a more comprehensive approach. They likely analyze nationwide risk factors, incorporating a wider dataset of claims data. Factors such as the cost of medical care and regional accident rates are probably considered in their pricing models. Allstate also uses a variety of strategies to adjust premiums, including customer loyalty programs, usage-based insurance, and different tiers of coverage.

Premium Comparison Example

| Coverage | Springs Insurance Premium (Example) | Allstate Insurance Premium (Example) |

|---|---|---|

| Basic Liability | $1,200 | $1,500 |

| Comprehensive Coverage | $1,800 | $2,200 |

| Full Coverage (Liability + Collision + Comprehensive) | $2,500 | $3,000 |

This example showcases a potential premium difference. The specific amounts vary significantly based on factors like driver profile, vehicle type, and geographic location.

Factors Influencing Premium Costs

Several factors impact insurance premiums for both companies. These include:

- Driving Record: A history of accidents or traffic violations typically results in higher premiums for both companies.

- Vehicle Type: The value, age, and type of vehicle (e.g., sports car vs. sedan) influence the risk assessment and thus premium amounts.

- Location: Areas with higher rates of accidents or severe weather events will generally have higher premiums.

- Coverage Level: More comprehensive coverage levels typically result in higher premiums.

- Deductible: Higher deductibles reduce premiums, but the policyholder must cover a larger amount in the event of a claim.

These factors demonstrate the complex interplay between risk assessment and premium calculations.

Premium Differences by Policy Type, Springs insurance: allstate insurance

| Policy Type | Springs Insurance Premium Difference | Allstate Insurance Premium Difference |

|---|---|---|

| Auto | Typically varies depending on the specific coverage, but can range from 5-15% higher/lower compared to Allstate. | Can vary widely depending on the driver profile, vehicle type, and location. |

| Homeowners | Difference likely determined by factors such as local property values, fire risks, and claims history. | Likely based on factors such as property value, local crime rates, and historical claims. |

| Commercial | Differences influenced by the nature of the business, location, and risk factors. | Based on industry, location, and specific business risks. |

Premium differences between policy types are driven by the inherent risks associated with each coverage area.

Final Review: Springs Insurance: Allstate Insurance

In conclusion, this in-depth comparison of Springs Insurance and Allstate Insurance offers a clear picture of each company’s strengths and weaknesses. Understanding their policy offerings, customer service, and financial standing empowers individuals to select the best insurance fit for their needs. The insights presented here encourage a well-informed decision-making process.

FAQ Overview

What are the typical premium differences between homeowners and auto insurance policies?

Premium differences depend on various factors, including location, coverage levels, and driver profiles (for auto). Springs Insurance and Allstate typically adjust premiums based on these factors, but the exact figures vary.

How long does the claims process typically take with Springs Insurance?

Claims resolution times with Springs Insurance can vary, depending on the claim type and complexity. A detailed overview of typical claim handling timelines is available on their website.

Does Allstate offer discounts for multiple policies?

Yes, Allstate frequently offers discounts for bundling multiple policies, such as auto and homeowners. Details on these discounts are available on their website.

What are the specific exclusions for life insurance policies with both companies?

Specific exclusions vary by policy and may include pre-existing conditions, certain activities, or specific circumstances. Policy documents should be consulted for precise details.